Deciding amongst a Gold IRA and physical gold can be difficult. Both offer possible opportunities for investors, but they work differently.

A Gold IRA allows you to invest in gold through a retirement account, providing tax advantages and potential growth. Conversely, owning physical gold means you have tangible assets that can be stored Best gold ira securely. The best choice depends on your individual financial goals, risk tolerance, and investment strategy.

Consider elements such as:

* **Your Investment Timeline:** Are you looking for short-term gains or long-term wealth accumulation?

* **Tax Implications:** How will government regulations affect your investments?

* **Liquidity Needs:** Do you require easy access to your funds or are you comfortable with illiquid assets?

Consulting with a qualified financial advisor can help you navigate these considerations and determine the most suitable gold investment option for your circumstances.

Investing in Gold IRAs vs 401(k) A Thorough Comparison

Deciding between a Roth IRA and a 401(k) can be complex, especially when considering the allure of precious metals. Both offer valuable benefits for retirement savings, but their approaches differ significantly. A Gold IRA allows you to invest in physical gold and other assets, while a 401(k) typically focuses on stocks, bonds, and mutual funds.

- Let's the key differences between these two retirement vehicles:

Investment choices are a crucial consideration. Gold IRAs primarily focus on physical gold, while 401(k)s offer a broader selection of investments, including stocks, bonds, and mutual funds.

Financial Goals plays a major role in your decision. Gold IRAs are often seen as a hedge against inflation, but they can also be volatile. 401(k)s, on the other hand, generally carry higher risk potential due to their dependence on market fluctuations.

Pros and Cons of a Gold IRA: Weighing the Benefits and Risks

Deciding to invest in a Gold IRA can be a tricky decision, requiring careful consideration of both the potential benefits and the inherent risks. A Gold IRA offers many possible benefits, including asset allocation to mitigate overall financial uncertainty and the potential for value growth in precious metals. However, it's also essential to acknowledge the cons associated with this type of investment vehicle. For instance, volatile gold prices can lead to capital depreciation, and maintenance costs for physical gold can be substantial.

- Furthermore, Gold IRAs often have increased costs compared to traditional IRAs.

- In conclusion, the decision of whether a Gold IRA is right for you depends on your individual circumstances. It's crucial to conduct thorough research all aspects before making this financial choice.

Crafting Your Golden Retirement: Top-Rated Gold IRAs

Embarking toward the path to a secure retirement involves meticulously selecting financial options that align with your goals. Among them, gold IRAs have emerged as a popular choice for savvy investors seeking diversification. A Gold IRA allows you to place precious metals, like gold, into an tax-advantaged retirement account, potentially providing benefits such as inflation hedge.

When selecting a Gold IRA provider, it's crucial to research different options based on factors like expenses, customer service, and track record.

Here's a quick overview of some top-rated Gold IRA providers to get you started:

- Provider B

- Provider E

Unveiling Wealth with a Gold IRA: A Guide to Investing in Precious Metals

Considering the allure of precious metals and aiming for diversification within your retirement portfolio? A Gold IRA, or Individual Retirement Account invested in physical gold, could be {an|a valuable tool. This type of IRA allows you to protect a portion of your savings in coins, offering potential protection against inflation and market volatility.

- Before| embarking on this investment journey, is crucial to thoroughly understand the drawbacks associated with a Gold IRA.

- Investigate numerous reputable companies specializing in Gold IRAs.

- Ensure the firm is registered with the Securities and Exchange Commission (SEC) and complies with industry regulations.

By carefully evaluating your financial goals and understanding the nuances of Gold IRAs, you can formulate an informed decision about whether this investment strategy aligns with your long-term plan.

Is a Gold IRA Right for You?

Thinking about safeguarding your portfolio with a gold IRA ? While gold can hold value during volatile times, a Gold IRA isn't for everyone. Before you commit , consider these key elements .

- Your financial goals

- Risk tolerance

- Diversification strategy

Seeking advice a qualified financial advisor is essential to determine if a Gold IRA aligns your specific circumstances . Remember, due diligence is crucial before making any investment decisions .

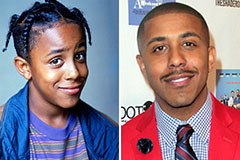

Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now!